Shipping your products' efficiently is vital to managing a successful Shopify enterprise. This comprehensive guide will equip you with the skills to enhance your shipping process, saving costs and enhancing customer delight.

From selecting the best shipping services to setting up efficient order fulfillment, we'll cover every aspect of Shopify shipping.

Let's embark into the world of effective shipping and transform your Shopify store.

Summarize the key factors you'll discover in this guide:

* Assessing shipping expenses and methods

* Choosing the best shipping services for your business

* Setting up Shopify's built-in shipping options

* Designing custom shipping strategies

* Automating order fulfillment and shipping processes

* Monitoring shipments and offering real-time updates to customers

Simplify Your Sales Tax Collection Using Shopify Tax Settings

Running an ecommerce business can be a breeze with Shopify's robust platform. One often-overlooked aspect is sales tax collection. Thankfully, Shopify offers comprehensive settings that can streamline this process for you. By configuring your tax rates, zones, and exemptions accurately, you can ensure compliance with regulatory requirements while avoiding costly penalties.

Start by identifying the jurisdictions where you have sales. Shopify's intuitive interface allows you to easily add these locations and your tax rates are applied correctly. Don't forget to set up exemptions for qualifying purchases, like qualified items or specific customer types. get more info

- Employ Shopify's automatic tax calculation feature to simplify your workflow.

- Monitor your sales tax reports regularly for identify any discrepancies.

- Seek Shopify support for assistance with complex tax situations.

Determining Shipping Costs in Shopify: Optimize for Profit

Running a profitable Shopify store means keeping a close eye on your costs and maximizing profits. One crucial element often overlooked is shipping. Setting the right transport rates can be tricky, as it you need to balance customer expectations with your own bottom line. Fortunately, Shopify provides a suite of tools to help you determine shipping costs accurately and strategically optimize them for growth.

- Utilize Shopify's built-in shipping calculator to get real-time rates based on weight, dimensions, and destination.

- Explore different shipping choices like flat rate, per-order, or calculated transport.

- Configure your shipping zones to group customers by location and apply appropriate rates.

- Offer free shipping deals as a powerful marketing tool to increase sales.

By taking the time to understand your shipping costs and strategically configure your settings, you can reduce expenses while still offering a positive customer experience.

Grasping Shopify Shipping Rates & Carriers

When you're running an online store on Shopify, shipping costs are a crucial part of your business. To ensure profitability and please your customers, it's essential to grasp how Shopify's shipping rates and copyright options operate.

Shopify provides a range of built-in shipping strategies, permitting you to select the best fit for your business needs. You can determine rates based on weight, dimensions, destination, or even a combination of these factors.

- Additionally, Shopify integrates with diverse popular shipping carriers, including UPS, FedEx, USPS, and DHL, providing you choices to ship your orders effectively.

- For manage shipping rates and carriers within Shopify, navigate to the "Shipping" section in your admin dashboard. There you can modify your shipping settings, include new carriers, and establish custom shipping zones based on location.

Via grasping these parameters, you can optimize your shipping process, reduce costs, and deliver a seamless shopping experience for your customers.

Streamline Taxes in Shopify: Easy & Efficient

Running a successful Shopify store means managing numerous tasks, and tax calculations are often a headache. But don't worry! Setting up automatic taxes in Shopify is surprisingly straightforward. It can reduce you valuable time and ensure your transactions are always correct.

Firstly, head to the Tax settings within your Shopify admin. Here, you can adjust various tax parameters based on your country. You'll need to specify your tax rates and jurisdictions to ensure proper application.

- Employ Shopify's pre-built tax rates for common regions, or manually input custom rates for specific scenarios.

- To simplify the process further, consider connecting your Shopify store with a third-party tax application. This can handle complex tax calculations and confirm compliance with all applicable regulations.

By implementing these simple steps, you can seamlessly set up automatic taxes in Shopify. This will not only enhance your efficiency but also reduce the risk of errors and potential penalties.

Shipping & Tax Strategies for Shopify Businesses: Grow & Scale

To truly maximize your Shopify business growth and expansion, a keen eye on shipping and tax strategies is essential. Effectively controlling these factors can dramatically impact your bottom line and customer experience. Start by meticulously choosing a shipping service that aligns your business needs, offering competitive rates and reliable transit times.

- Implement a clear tax structure to guarantee compliance with all relevant regulations.

- Leverage Shopify's built-in features for simplifying tax calculations and reports.

- Proactively monitor your shipping and tax data to identify opportunities for improvement.

By implementing these best practices, you can create a solid foundation for sustainable growth and success in the dynamic world of e-commerce.

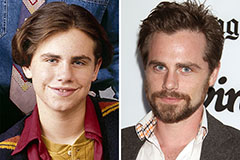

Rider Strong Then & Now!

Rider Strong Then & Now! Ashley Johnson Then & Now!

Ashley Johnson Then & Now! Christina Ricci Then & Now!

Christina Ricci Then & Now! Monica Lewinsky Then & Now!

Monica Lewinsky Then & Now! Mike Smith Then & Now!

Mike Smith Then & Now!